TL;DR: Tenderize offers liquid staking solutions on The Graph, ensuring your crypto stays liquid and works for you, thanks to innovative tools that stabilize liquidity and decentralize validator selection.

Tenderize is a liquid staking protocol where you can stake crypto and receive staking rewards without locking your deposit.

Read on to discover more about Tenderize, its approach, and its connection to The Graph, so you can decide if you want to try it for yourself.

What is traditional staking?

If you have crypto assets and you plan to hold them for a long time, staking them allows you to earn rewards. You’re putting your assets to work for you. You’re also helping the blockchain network be more secure and efficient.

A new approach—liquid staking—is beginning to capture the attention of investors and crypto enthusiasts.

Diving into liquid staking

Liquid staking allows you to stake your digital assets while retaining liquidity.

Unlike traditional staking, where assets are locked for a certain period, liquid staking allows you to earn staking rewards without sacrificing access to your assets. This approach enhances the flexibility and efficiency of staking and opens up new avenues for earning potential within decentralized finance (DeFi).

The allure of liquid staking is its ability to solve the liquidity problem. By enabling stakers to remain liquid, they can continue to engage in other investment opportunities. They’re not tied down by their staked assets.

Some popular liquid staking protocols are RocketPool with rETH or Lido with stETH.

What is Tenderize?

Tenderize is a platform designed to facilitate liquid staking for various blockchain networks, including The Graph. Its primary mission is to provide people with the ability to stake their digital assets in a way that allows them to remain liquid, rather than locked, thereby addressing one of the key limitations of traditional staking methods.

Take a look at this video from Tenderize that gives a good overview of how the protocol works.

Tenderize video from launch of V2.

Switch N’Earn

Tenderize launched its Switch N’Earn campaign this April. It enables existing delegators on The Graph to switch over to Tenderize using its dApp.

Upon participating, stakers connect their wallet, choose their desired validator, and confirm the switch. This seamless transition allows for the continuous accrual of staking rewards. As another incentive, participants are rewarded with HATS, which can be converted into Tenderize’s governance token, WAGYU, adding more flexibility and rewards to the staking experience.

What differences does Tenderize introduce?

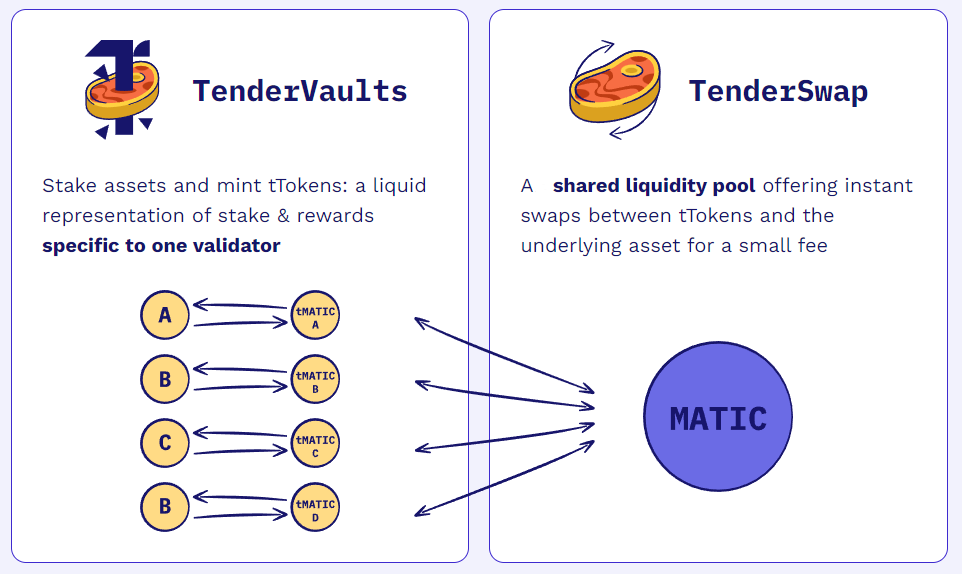

- Democratizing validator selection: TenderVault mints liquid staked tokens (LSTs) for validators, symbolizing specific stakes and rewards, and decentralizing stake distribution beyond select validators. This helps prevent any stake from being controlled by a few or selected validators. For example, Lido controls 32% of all staked ETH and 20% of all ETH.

- Isolating validator risks: Tenderize addresses the issue of socialized risk inherent in traditional liquid staking protocols, where a shared token’s performance is affected by the collective actions of a group of validators. This often means that if one validator is penalized, all token holders face the consequences. By introducing TenderVault, Tenderize creates individual LSTs for each validator, ensuring that the rewards and risks are unique to that validator’s performance. This approach isolates the impact of penalties, protecting users from the broader effects of a single validator’s actions. To tackle fragmented and expensive on-chain liquidity, Tenderize uses TenderSwap, a novel decentralized exchange that enhances liquidity through a shared pool model. This significantly reduces the need for large incentives to maintain liquidity levels, cutting costs.

- Stabilizing liquidity sustainably: On-chain liquidity issues, including high costs and dispersion during market downturns, challenge assets like Coinbase cbETH and Lido stETH to maintain value without heavy incentive spending. Tenderize solves this by creating a system that doesn’t need to spend so much to stay stable and allows everyone to use it freely, keeping the network open and secure while avoiding big costs to maintain liquidity.

What role does Tenderize play in The Graph ecosystem?

Tenderize provides new entrants to The Graph with enhanced flexibility as delegators, offering the option to keep tokens liquid and enabling immediate swaps without the standard 28-day thaw period. If you prefer, you can also follow the native undelegation process.

Future plans include the possibility of taking loans against tGRT as collateral and using rGRT in DeFi protocols, further expanding the utility and accessibility of delegated assets. Keep an eye on Tenderize’s docs for updates.

Indexers can benefit by offering more flexibility for delegators who want it, and Tenderize has offered some partnership grants.

Watch the snippet below from Community Talk #29, which hosted Tenderize, and see a live demo of how to liquid stake, swap, and undelegate your GRT tokens.

Connect with Tenderize

Tenderize welcomes you through various channels for support, questions, or to join the community. Stay updated with the latest news on X, explore your staking options on the Tenderize app, participate in the cookout campaign for special events, or dive into discussions on Discord. Each platform offers a unique way to engage with Tenderize and its vibrant community.

If you want to take the first step towards liquidity and enhanced rewards, visit the Tenderize website, explore their platform, read the docs, and join the Discord community. The world of liquid staking awaits—are you ready to dive in?

💡 This article answers questions like: - What is traditional staking? - What is liquid staking? - What is Tenderize and what services does it offer? - How is Tenderize connected to The Graph?

Great to have multiple options for those delegating! Excited to see future of Tenderize and how it will grow!