Why Solvers Are Key to DeFi and Why They’re Struggling

TL;DR: Tycho is a revolutionary tool that simplifies the work of DeFi solvers, entities responsible for optimizing and executing trades on DEXs. By leveraging The Graph and Substreams, Tycho provides real-time data indexing, standardized trade simulations, and secure execution, reducing complexity and making DeFi more decentralized and efficient. This innovation helps solvers compete more fairly, minimizes execution risks, and ensures DeFi remains accessible.

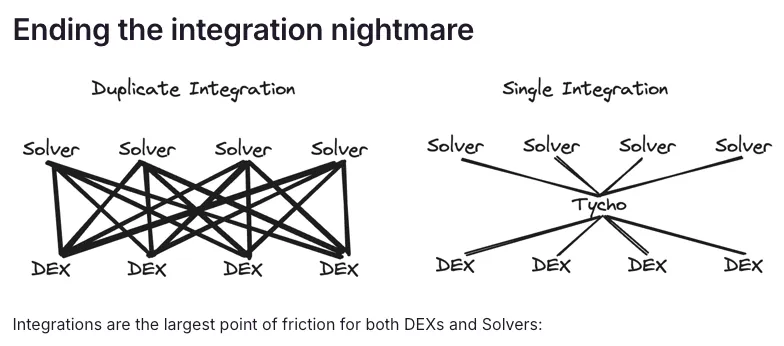

DeFi is built on promises of decentralization, low fees, and permissionless access. But behind every trade executed on decentralized exchanges (DEXs) lies a hidden struggle: solvers – the entities responsible for routing and optimizing trades. Their job involves integrating with various liquidity protocols, managing user assets securely and competing in high-pressure auction environments.

As Marcus from Propeller Heads explains, solvers are the middlemen who connect traders to on-chain liquidity. However, their work is so complex that only a few established players dominate, leading to potential centralization risks. Fortunately, a new tool called Tycho is making it easier for solvers to operate. It’s all possible thanks to The Graph and Substreams.

The challenge: decentralization is slowing down

Marcus outlines the obstacles solvers face:

- Fragmented liquidity protocols:

- Every DEX and liquidity pool has different mathematical models and APIs. Solvers must manually understand and integrate each protocol.

- High risks in execution:

- Solvers need to manage user assets while building custom execution contracts for each DEX, leaving room for errors and hacks.

- Steep barrier to entry:

- Integrating with multiple DEXs requires significant time and resources, making it nearly impossible for new solvers to compete.

These challenges create bottlenecks, making DeFi less accessible and more centralized. But Tycho, built on Substreams and The Graph, is flipping this narrative.

Enter Tycho: The tool solvers have been waiting for

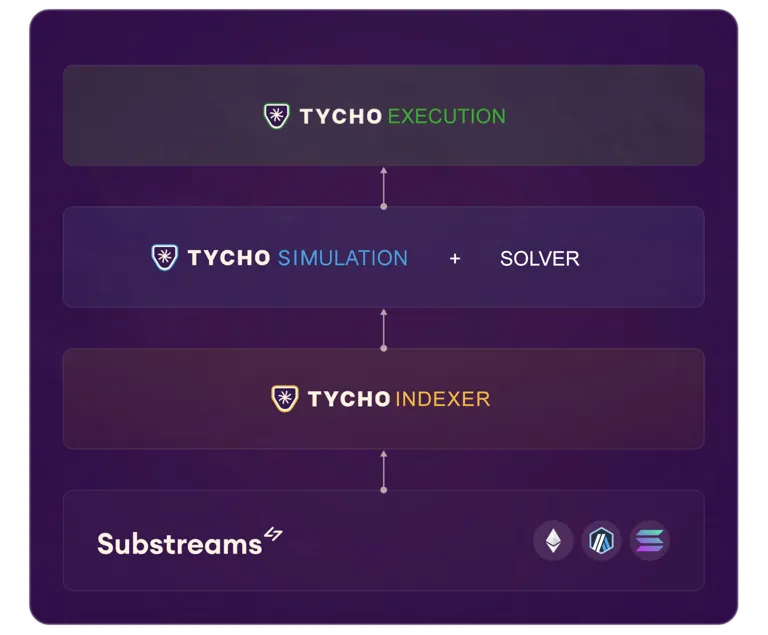

Tycho streamlines the entire process of indexing, simulating, and executing trades by leveraging The Graph’s decentralized indexing protocol and Substreams’ real-time data processing.

Here’s how:

1. Indexing with Substreams: real-time, low-latency data

Traditionally, solvers rely on slow, repetitive JSON-RPC calls to gather on-chain data, similar to making thousands of individual API requests to a database. Substreams solves this by reversing the flow of information:

- Instead of solvers querying for data, Substreams streams real-time updates directly to them after every block.

- This allows solvers to access up-to-date information on pool states, trades, and liquidity changes with sub-100 millisecond latency.

Marcus highlights the speed improvement:

Without parallel processing, indexing large protocols like Uniswap V3 would take months. With Substreams, you can do it in hours.”

By leveraging geographically distributed nodes and parallel processing, Substreams makes it easy for solvers to index even the most complex DeFi protocols quickly.

2. Simulating trades using standardized data

One of the hardest parts of a solver’s job is simulating trades across different protocols. Each DEX uses its own pricing models, making solvers replicate the math for each pool manually. Tycho solves this using a combination of:

- The Graph’s ability to aggregate historical state data for accurate simulations.

- ERC-7815, a standardized interface for trade simulation.

With this standardization, solvers no longer need to worry about individual DEX-specific quirks. Tycho handles it all, allowing solvers to query simulations in real time without rebuilding everything from scratch.

For solvers, Tycho is like having a one-size-fits-all solution. You don’t need to know how each DEX calculates pricing – you just query the interface, and it works.”

3. Executing trades securely using audited contracts

Execution is where things often go wrong. Solvers must write custom contracts to interface with each liquidity pool, and any mistake can result in hacks or lost funds. Tycho eliminates this risk with:

- Pre-built, audited adapters and routers for every major DEX.

- A system where DEXs integrate with Tycho before launch, ensuring solvers can execute trades safely from day one.

This approach removes the need for solvers to build execution contracts from scratch, reducing both risk and time-to-market.

Why The Graph and Substreams are game-changers for DeFi

The success of Tycho is rooted in how The Graph and Substreams improve data accessibility and standardization across the DeFi ecosystem:

- Real-time data access: Substreams ensures solvers always have the latest data, reducing the need for manual queries.

- Historical context: The Graph’s indexing capabilities allow solvers to access past states of liquidity pools, making accurate simulations possible.

- Unified interfaces: With ERC-7815 and The Graph’s ability to aggregate data, solvers can interact with any DEX using a single standard interface.

By combining these technologies, Tycho lowers the barrier to entry for solvers and DEXs alike, fostering a more decentralized DeFi landscape.

What this means for DeFi’s future

Here’s what to expect as Tycho gains adoption:

- More solvers entering the market, increasing competition and reducing centralization risks.

- Faster DEX adoption, as new protocols can integrate seamlessly using Tycho’s standardized interfaces.

- Lower fees for users, thanks to a more competitive and efficient ecosystem.

Marcus emphasizes that simplifying the solver’s job is critical to keeping DeFi decentralized:

If we don’t reduce the complexity of integrating with on-chain liquidity, DeFi will centralize around a few dominant solvers and market makers. Tycho changes that by making it easier for new solvers to enter and compete.”

Ready to explore Tycho?

If you’re a developer or DEX looking to simplify trade execution, now’s the time to explore what Tycho can offer. By leveraging The Graph and Substreams, Tycho is transforming how solvers and DEXs interact, making DeFi more efficient, secure, and decentralized. With the barrier to entry lowered, the future of DeFi looks brighter and more accessible than ever before. Visit Propeller Heads’ GitHub repository to get started or reach out to their team for more information.

💡 This article answers questions like:

✅ What are DeFi solvers, and why do they struggle?

✅ How does Tycho improve trade execution for solvers?

✅ How do The Graph and Substreams power Tycho’s real-time indexing and simulations?

✅ What impact will Tycho have on the decentralization of DeFi?

No Comments